Interest rates are only part of the story

The short answer is yes. However, it is a much more complicated puzzle than just mortgage interest rates that affect the housing market.

It would be more accurate to focus on the word affordability in terms of the housing market because of all it encompasses. It is a multipronged, dynamic and influential moving target, where affordability is determined by mortgage interest rates, housing availability, wages, and inflation.

As we all know, there has been an extreme housing shortage in the Puget Sound region, causing home prices to skyrocket, and forcing many buyers out of the housing market because their wages have not kept pace. Interest rates, as low as they are, can still cause disruption to the buying power of house hunting prospects with every uptick. While inflation, though low by historical standards, is still there and eating away at their ability to save money for down payments.

Having said that, it is my opinion that this may be the best real estate market in decades, and because of typical housing cycles, we may not see another one like it for years to come. I base my opinion on all that I mentioned above: interest rates, wage growth, and inflation. See the charts below:

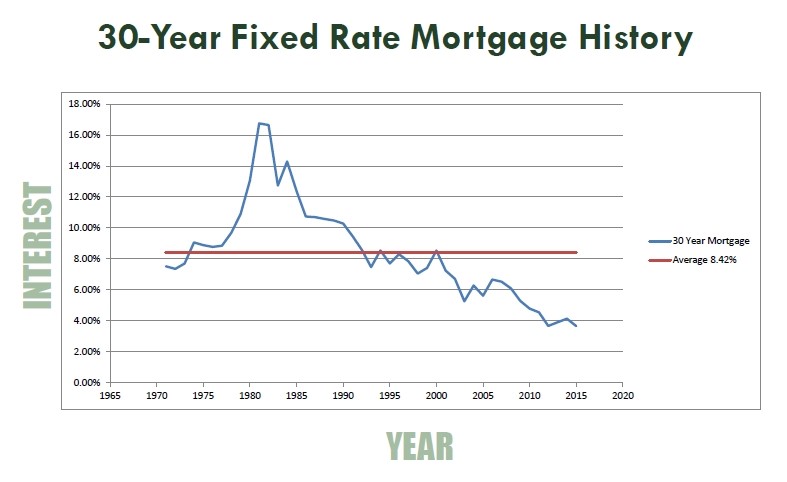

Interest rate history

Rates remain at historic lows with the 30 year average being around 8%.

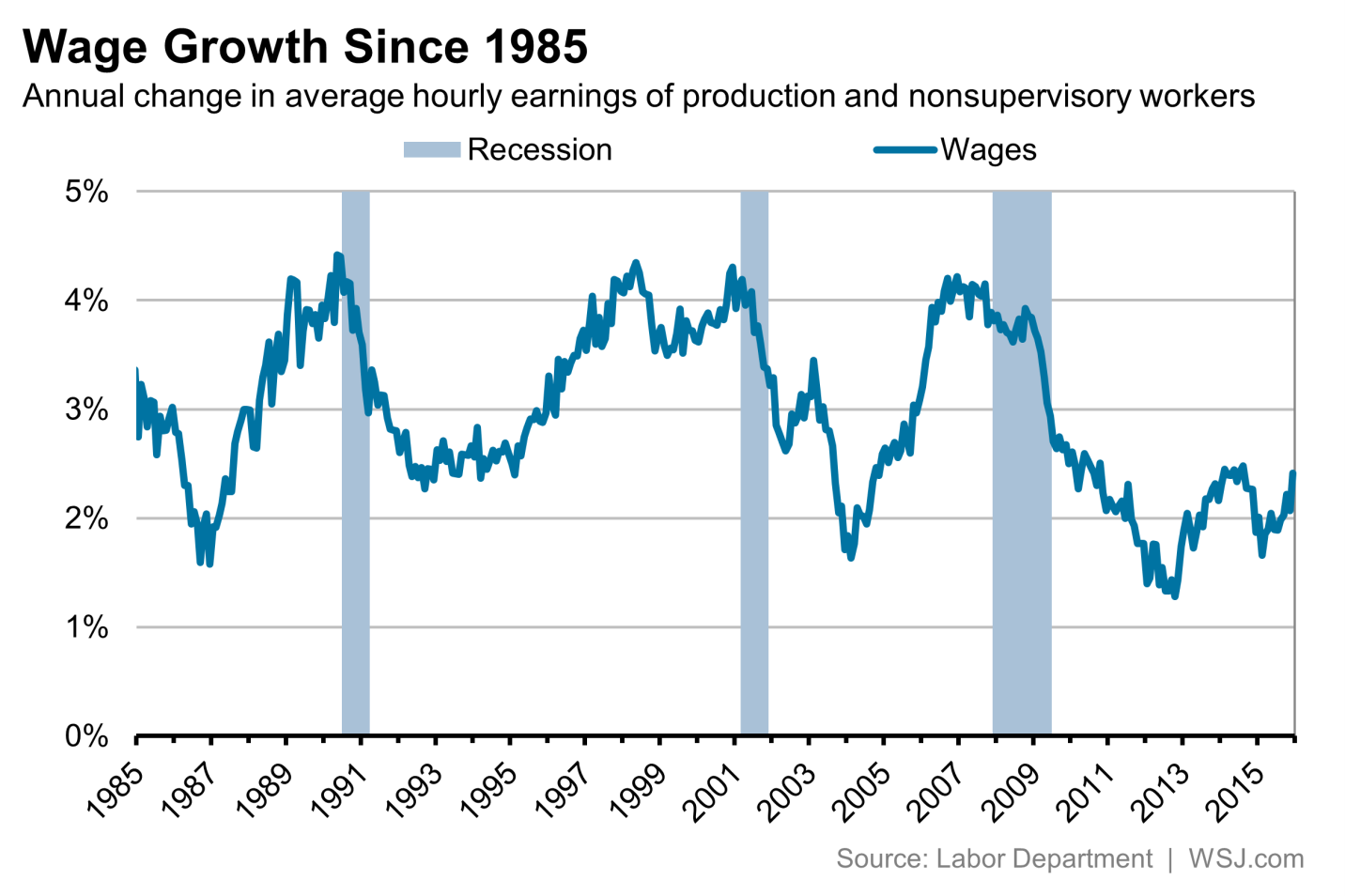

Wage growth history

Wages, until recently, have been stagnant. However, we are starting to see improvement.

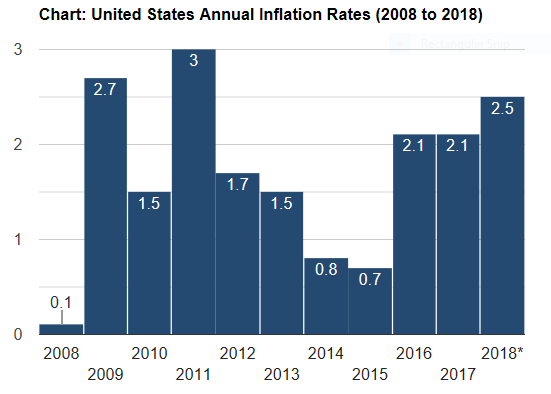

Inflation history

Inflation has also been below average and continues to remain low.

The economy is strong. Wages are on the rise. Interest rates are low, and inflation remains low. A change to the contrary in any of these sectors could adversely affect the real estate market we enjoy today. That is why I believe the time is now. Don’t wait for a better market to buy or sell a home, because there may never be a better one.